The crypto industry received a shock in 2022 when it was revealed that FTX was declaring bankruptcy. This led to doubts about whether exchanges truly hold the assets that customers entrusted to them or if they mismanage them as with the case of the collapsed exchange.

Going forward it became evident that Proof of Reserves (PoR) would be helpful in regaining customers’ confidence. Proof of Reserves simply implies to the independent audit conducted by smart contract audit companies on cryptocurrency exchanges to verify that they genuinely hold the assets that users have deposited on their platforms.

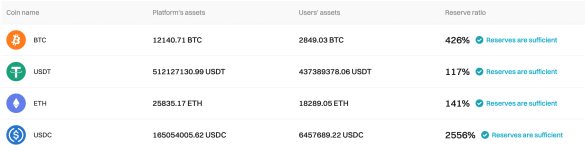

PoR has come to represent transparency and security in exchanges, as well as a dedication to building unwavering trust in their platforms. As of November 3, 2023, Bitget has gone one step further and published an exceptional reserve ratio of 199%, as seen on Coinmarketcap. This actually means that an extra dollar is set aside on the platform for each dollar a user deposits to guarantee the complete solvency and security of their assets.

Unfortunately, insecurity is one of the major challenges facing the crypto sector. The leading exchanges however are taking a number of steps to close the gaps and win back users’ confidence with PoR one of those measures.

Having experienced the regrettable FTX shutdown, are you most likely tilting towards exchanges with verifiable PoR over exchanges that are devoid of PoR?

Going forward it became evident that Proof of Reserves (PoR) would be helpful in regaining customers’ confidence. Proof of Reserves simply implies to the independent audit conducted by smart contract audit companies on cryptocurrency exchanges to verify that they genuinely hold the assets that users have deposited on their platforms.

PoR has come to represent transparency and security in exchanges, as well as a dedication to building unwavering trust in their platforms. As of November 3, 2023, Bitget has gone one step further and published an exceptional reserve ratio of 199%, as seen on Coinmarketcap. This actually means that an extra dollar is set aside on the platform for each dollar a user deposits to guarantee the complete solvency and security of their assets.

Unfortunately, insecurity is one of the major challenges facing the crypto sector. The leading exchanges however are taking a number of steps to close the gaps and win back users’ confidence with PoR one of those measures.

Having experienced the regrettable FTX shutdown, are you most likely tilting towards exchanges with verifiable PoR over exchanges that are devoid of PoR?