Maxicreed

Active member

The crypto space seems to experiencing witness more gains than losses since the birth of the concept of PoR. Records on CMC, CG and most top crypto news aggregator has practically shown how most top tier CEXes are on top of their gear consistently publishing results of their monthly audit reports.

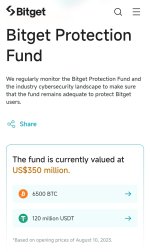

While waiting for most exchanges to publish theirs for this month; Bitget has already published theirs and have subsequently announced a strong reserve ratio of 199%. Tho, my take home from their announcements and that of other CEXes is the consistent improvement of reserves ratio which has been encouraging and to some extent calmed our nerves from any fear of another CEX disaster; consequently more adoption could be on card

While I feel PoR is win for the crypto industry, I guess it's also pertinent to have an agreed timeline for publishing these PoR and perhaps a website that collate these info for user to make comparative analysis. I may not be looking at the right direction but would appreciate where such collated info could be accessed for users consumption.

While waiting for most exchanges to publish theirs for this month; Bitget has already published theirs and have subsequently announced a strong reserve ratio of 199%. Tho, my take home from their announcements and that of other CEXes is the consistent improvement of reserves ratio which has been encouraging and to some extent calmed our nerves from any fear of another CEX disaster; consequently more adoption could be on card

While I feel PoR is win for the crypto industry, I guess it's also pertinent to have an agreed timeline for publishing these PoR and perhaps a website that collate these info for user to make comparative analysis. I may not be looking at the right direction but would appreciate where such collated info could be accessed for users consumption.