Traditional banking systems are known to be the gatekeepers of financial services, controlling how participants access loans, save, and invest in opportunities. Characterized by a centralized sysytem where a single authority such as a bank or government are in absolute control, this centralization is dented with limitations such as high fees, limited accessibility and sluggish transaction speed.

Dentralized finance (DeFi) was then introduced as a blockchain-based financial system that eliminates intermediaries or central authorities, leveraging smart contracts instead. By eschewing intermediaries, DeFi then offer key benefits like accessibility, allowing everyone with internet connection–irrespective of their location or status, access to financial system.

DeFi is also heralded for its transparency. While traditional banking system often limit customers’ view into how their funds are being managed, DeFi, on the other hand, utilizes a public blockchain, where anyone can audit transactions, building trust as a result and lessens the risk of fraud or manipulation.

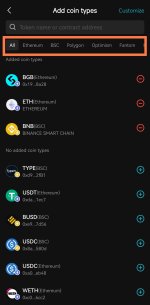

In addition to these benefits, DeFi also offers several financial services and products like lending and borrowing, DEX, stablecoins etc. that have proffered innovative solutions, and operates round the clock unlike its counterpart that has limited operating hours.

DeFi isn’t devoid of challenges as issues like inecurity and reliability of smart contracts are still a concern. Despite these challenges though, the growth of DeFi has been remarkable; since its inception, the total value locked in DeFi protocols has risen from hundreds of million dollars to billions in such a short span. This is a clear indication that the demand for DeFi services is on the rise.

DeFi seems to be transforming the financial industry by offering an alternative to traditional banking systems. As the adoption increases, can we expect to see a paradigm shift in the way we interact with and access financial services?

Dentralized finance (DeFi) was then introduced as a blockchain-based financial system that eliminates intermediaries or central authorities, leveraging smart contracts instead. By eschewing intermediaries, DeFi then offer key benefits like accessibility, allowing everyone with internet connection–irrespective of their location or status, access to financial system.

DeFi is also heralded for its transparency. While traditional banking system often limit customers’ view into how their funds are being managed, DeFi, on the other hand, utilizes a public blockchain, where anyone can audit transactions, building trust as a result and lessens the risk of fraud or manipulation.

In addition to these benefits, DeFi also offers several financial services and products like lending and borrowing, DEX, stablecoins etc. that have proffered innovative solutions, and operates round the clock unlike its counterpart that has limited operating hours.

DeFi isn’t devoid of challenges as issues like inecurity and reliability of smart contracts are still a concern. Despite these challenges though, the growth of DeFi has been remarkable; since its inception, the total value locked in DeFi protocols has risen from hundreds of million dollars to billions in such a short span. This is a clear indication that the demand for DeFi services is on the rise.

DeFi seems to be transforming the financial industry by offering an alternative to traditional banking systems. As the adoption increases, can we expect to see a paradigm shift in the way we interact with and access financial services?