Forex Forecast and Cryptocurrencies Forecast for April 19 - 23, 2021

First, a review of last week’s events:

- EUR/USD. The past week was marked by two important economic events: impressively strong macro-statistics from the USA and a collapse in the yield of 10-year US government bonds.

According to the data published on Thursday April 15, US retail sales jumped by +9.8% in March (against the forecast +5.9% and a fall of -2.7% in February), which is the best indicator for the last 10 months. What is happening on the labor market also shows an active recovery of the country's economy. Thus, the number of initial applications for unemployment benefits fell from 769 thousand to 576 thousand. And this is not just better than the predicted 700 thousand, this is the lowest level since the beginning of the COVID-19 pandemic. Industrial production grew by 2.7%.

All these figures clearly indicate the rapid growth of US GDP in the first quarter of 2021. and allow us to speak with confidence about its continuation in the coming months. Against this background, the collapse in the yield of American Treasuries, the strongest since the beginning of last November, looks surprising. If at the end of March, the yield on 10-year bonds reached a local multi-month maximum of 1.775%, now it has fallen to 1.583%.

Along with bonds, the dollar is weakening. The USD DXY index is trading in the 91.5 zone on Friday, April 16, which is 180 points below this year's high of 93.3. As a result, as predicted by most experts (65%), the EUR/USD pair continued its growth last week, coming close to the important support/resistance level of 1.2000 and ending the five-day period at 1.1980.

This situation suggests that strong economic statistics from the United States can no longer provide serious support to the US currency. And the latter is now more correlated with the yield on Treasury bonds. Apparently, the rate of vaccination against coronavirus has already been taken into account in the USD quotes. And new fiscal stimulus programs and endless printing of new money by the Federal Reserve started working against the dollar. Its weakening has already gone beyond the usual correction, heating up the risk sentiments of investors: in addition to the euro, the currencies of commodity and developing countries are also growing, and the S&P500 index renews its all-time high for the 22nd time this year;

- GBP/USD. The weakening dollar supported the British currency, the fall of the GBP/USD pair stopped, and it even managed to climb 120 points. Thus, its movement over the past four weeks can be defined as lateralin channel 1.3670-1.3920. As for the last chord, the pair placed it in the central zone of this channel, ending the trading session at 1.3840;

- USD/JPY. It was said above about a sharp drop in the yield on 10-year US Treasury bonds. Experts call the coverage of short positions by hedge funds, as well as the return of Japanese buyers to the market, among the possible reasons for this collapse. They were actively getting rid of American bonds at the end of the financial year, but they began to replenish their investment portfolios with them now. This led to an increase in demand for the yen, which, thanks to the negative interest rate, they use to finance such operations.

One of the scenarios pronounced a week ago suggested that the weakening of the dollar and the strengthening of the yen would push the pair USD/JPY towards the support of 108.40. This is exactly what happened: starting from the level of 109.65, the pair dropped to the horizon 108.60 by Thursday, April 15, followed by a small rebound and a finish at 108.80;

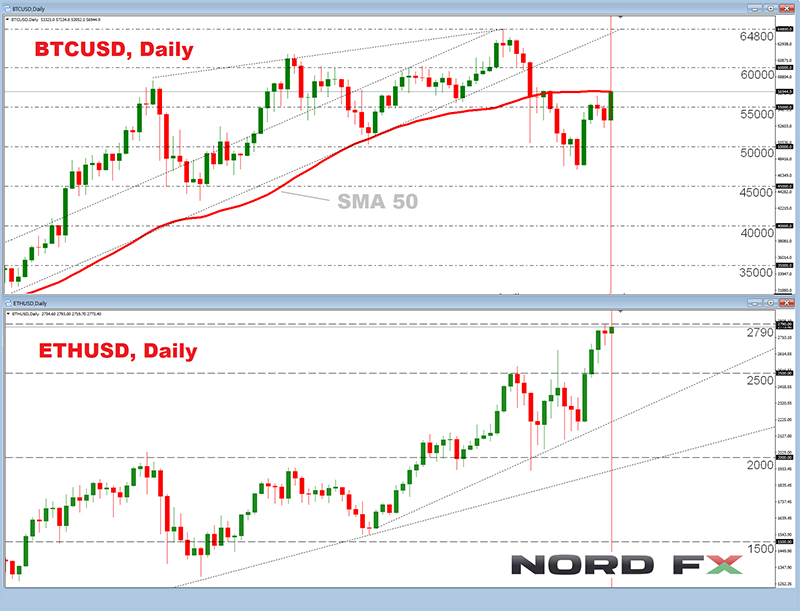

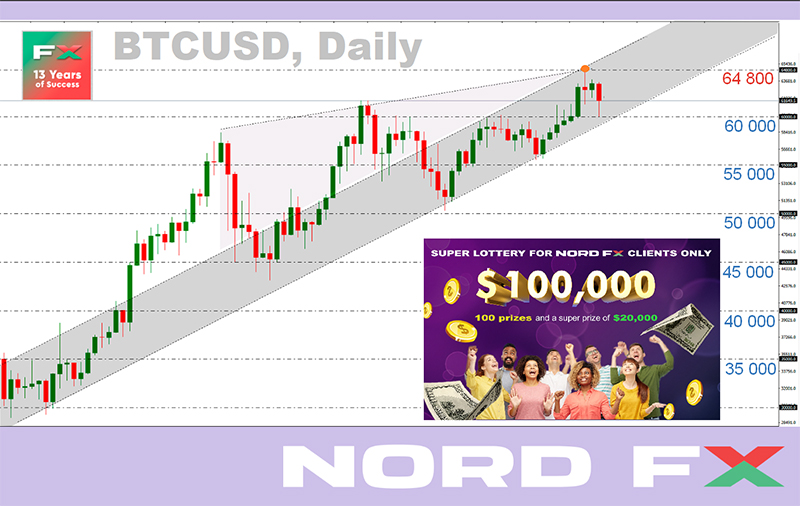

- cryptocurrencies. What has been so much anticipated over the past eight weeks has come true: Bitcoin has finally broken through the $60,000 horizon and is now trying to gain a foothold above this important psychological level. The new historical high was the height of $64,800, which the BTC/USD pair reached on Wednesday April 14. However, a correction followed, and the bulls were struggling to prevent the main cryptocurrency from falling below $60,000 for the whole of Friday, April 16.

According to the Forbes rating, thanks to the growth of bitcoin, its creator under the pseudonym Satoshi Nakamoto got into the top 20 richest people in the world. According to various estimates, he owns between 750k and 1.1 million BTC coins, and his fortune has exceeded $60 billion now.

But if Nakamoto became the owner of countless crypto-treasures a long time ago, then the current large investors are only at the beginning of their journey. According to the analytical service Santiment, the so-called "whales" continue to accumulate bitcoins. Analysts found that they have accumulated up to 2.2% of the total cryptocurrency market supply so far, reaching an 11-month high. A similar situation was observed at the beginning of May last year. As the Santiment report says, we are talking about investors controlling 100,000 or more BTC.

Along with the "whales", for the first time since December 2020, miners have also started to accumulate savings, which creates a shortage of supply and contributes to an increase in the price of the main digital asset.

Miners receive income in cryptocurrency, but they pay fiat to service and equipment providers, so they are forced to sell part of the mined coins. The volumes of such sales depend on current market conditions and expectations of the bitcoin price. Starting from March 31, miners started accumulating BTC reserves again. Whereas for four months before that, they reduced their positions, converting bitcoins to fiat. The largest volumes of cryptocurrency, from 17,000 to 24,000 BTC per day, were sold by them in January 2021.

“Miners have switched to accumulating digital assets, because they have enough cash reserves to support their activities, which they raised during the rise of bitcoin from $20,000 to $40,000. Or, most of them are holding coins in anticipation of further appreciation,” Flex Young, CEO of Hong Kong-based Babel Finance, told CoinDesk. The number of bitcoins in miners' wallets has increased to 1.806 million BTC over the past two weeks.

The growth of the BTC/USD pair is facilitated by a weak dollar and a decrease in the yield of long-term US government bonds as well. This increases the attractiveness of cryptocurrency as a hedge against inflation.

The total crypto market capitalization on April 10 finally crossed the $ 2.0 trillion bar, and never fell below it. At the time of this writing, on April 16, it is at $ 2.2 trillion.

At the same time, the share of bitcoin in the total crypto market capitalization continues to decline continuously: if it was 72.65% on January 2, then it was only 52.10% on April 16. As already mentioned, this is most likely due to the fact that speculators are switching to other, more profitable, assets.

As for the Crypto Fear & Greed Index, it rose from 70 to 78 points in a week. Both values are in the overbought zone, but they are still far from critical, and therefore cannot become a serious obstacle to the growth of the BTC/USD pair.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

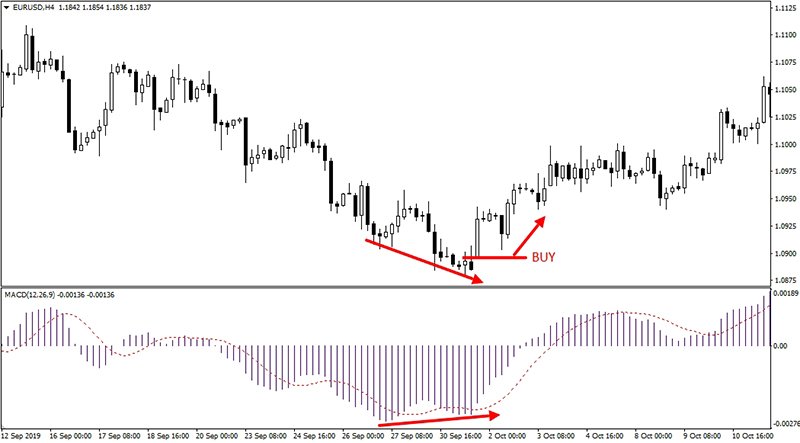

- EUR/USD. As mentioned in the first part of the review, trillions of dollars of economic support programs not only increase the US national debt, but also begin to put serious pressure on the American currency. Low, close to zero interest rates do not help it either. But at the same time, the head of the FRS says that although the pace of the US economic recovery is impressive, it is not enough to even begin to discuss the curtailment of fiscal stimulus programs. According to Jerome Powell, this requires several more months of such positive results. The economy must “make even more significant progress” towards target levels of employment and inflation.

Of course, such statements are not good for the dollar and contribute to the growth of risk sentiment. But as for the other side of the Atlantic Ocean, there are more and more vigorous statements of EU officials about the imminent termination of lockdowns and the unprecedented growth of the Eurozone economy. According to the consensus forecast of Bloomberg experts, the ECB will slow down the emergency asset purchase (QE) program by July, and at the end of this year will announce its termination in March 2022.

All of the above could lead to the EUR/USD breakout of the 1.2000 resistance and its rise to the January highs in the 1.2300 area. Resistances on this path will be the levels 1.2125 and 1.2185.

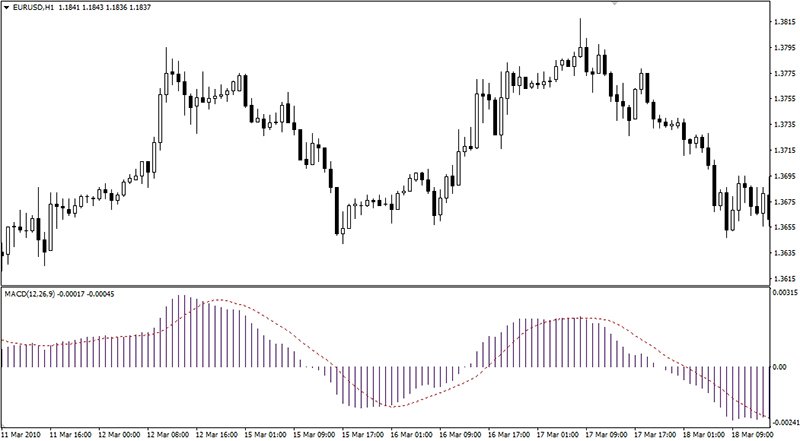

However, at the moment such a bullish forecast is supported by only 25% of experts. True, graphical analysis, 100% of trend indicators on H4 and 90% on D1 are on their side. The picture is slightly different among oscillators. Only 65% of oscillators on both time frames are colored green, while the rest are already giving signals that the pair is overbought.

The majority of analysts (50%) have now taken a neutral position, believing that the bulls and the bears will be engaged in “tug-of-war” across the 1.2000 line in the near future. But the victory will still be with the dollar in the future. And, when moving from weekly to monthly forecast, the number of supporters of bears increases from 25% to 70%. In their opinion, the EUR / USD pair will test the support in the 1.1700 zone once again and, if successful, will drop another 100 points lower.

As for the events of the coming week, we should pay attention to Thursday April 22. The next ECB meeting will be held on that day. Any special changes in its monetary policy are not likely to be foreseen. However, the press conference of the management of the European Central Bank is of interest, during which investors can receive positive signals about the intentions of this regulator. If the business activity indicators in Germany and the Eurozone, which will be released the next day, April 23, also turn out to be encouraging, this could support the euro;

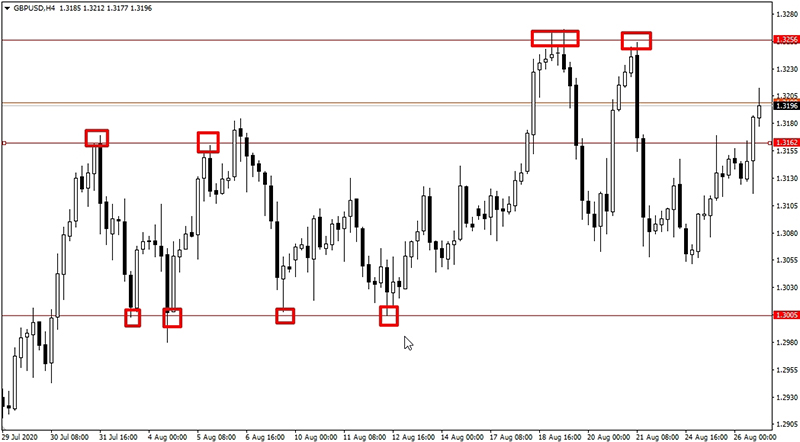

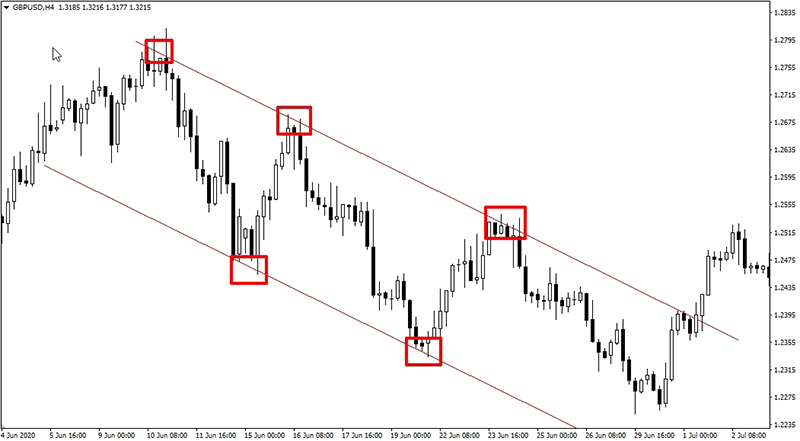

- GBP/USD. Problems after the UK's exit from the EU, an impressive trade deficit and the country's budget deficit continue to put pressure on the pound. And even the dollar, which weakened against other currencies, let the GBP/USD pair get just a sideways trend, but never return to sustainable growth.

The British currency may regain its attractiveness, especially if large capital that left it due to Brexit begins to return to the country. The pound is also supported by the successes of vaccination against COVID-19. Therefore, some analysts believe that the long-term uptrend, which began on March 20, 2020, is too early to be buried, and the pair has a chance to continue its movement to the north. 30% of experts vote for the bullish forecast at the moment. However, when switching to forecasting by the end of spring, their number doubles: up to 60%. The nearest resistance levels are 1.3920 and 1.4000.

In the meantime, the overwhelming majority of analysts, supported by graphical analysis on D1, first expect the pair to drop to the lower border of the 1.3670-1.3920 trading channel, and in case of its breakdown, the pair will move to the 1.3600 zone.

Among the events of the coming week that can influence the formation of local trends, we can note the release of statistics on the UK labor market on Tuesday April 20, data on the consumer market on Wednesday April 21, and business activity in the Markit service sector.¬ on Friday April 23. Noteworthy is the speech of the head of the Bank of England Andrew Bailey on April 21 as well;

- USD/JPY. The pair starts the next week within the zone 108.60-109.25. Recall that this is the very narrow trading range from which it could not get out for three whole weeks in March. And it is quite possible that now it will become a serious obstacle on the path of the yen to further strengthening. Graphical analysis completely agrees with this version. According to its forecast on the H4 and D1 timeframes, before continuing to move south, the USD/JPY pair will be squeezed within these limits for several days.

And 70% of analysts are sure that the pair will continue to decline. Support levels are 108.35, 107.50 and 106.00; The remaining 30% expect the pair to bounce up. Resistances are at 109.25 and 110.00, the goal is to overcome the March 31 high of 110.95 and take the height of 111.00;

- cryptocurrencies. The most optimistic forecast for the bitcoin price was given by the authors of the cult animated series The Simpsons. A running line with quotes of financial assets appears on the TV screen in the new 18th episode of season 32. The bitcoin exchange rate is marked with a green sign of infinity.

Of course, such dynamics would greatly delight investors. However, the forecasts of specialists still look much more modest. Although they also strive upward. So, according to the latest report of the Kraken exchange, its analysts, relying on historical data, admitted the growth of bitcoin by 50% in April. Taking into account that the month began at $59,000, the target of the movement could be the $90,000 mark. However, before the rally resumes, the first cryptocurrency can expect a correction of at least $10,000.

As for the second major cryptocurrency, Ethereum, Kraken predicts it could rise to $15,000. Exchange analysts noted the important, in their opinion, support and resistance levels for this altcoin: $1,462 and $2,695. Plotting historical patterns of ETH price movement on logarithmic curves, they concluded that the peak of the bullish cycle is still far away. The experts are confident that the price of Ethereum could rise by 700% from the levels of the end of March and reach a high at $15,238.

A slightly more modest forecast for the price of this altcoin was given by the famous crypto trader and host of the podcast The Wolf Of All Streets Scott Melker. According to him, Ethereum may surpass bitcoin in terms of profitability in 2021, and the price of the coin may rise to $10,000.

He revealed In an interview with Cointelegraph that he has largely switched his strategy from the first cryptocurrency to ETH in recent months. “I don’t understand why this is crazy. In fact, this is just an increase of less than five times the current price. Bitcoin almost tripled last year,” Melker told reporters. “It reminds me of investing in the Internet in the early 1990s.”

Maciej Vitkoviak looked even deeper into the history, revealing to the world a crypto-life hack of almost 40 years ago - an emulator of a vintage computer Commodore-64 from 1982, adapted for mining bitcoins. This developer has created the C64 Bitcoin Miner software specifically for this PC. He demonstrated a hashrate of 0.2 H/s on the VICE emulator, which will allow him to get a block of BTC “in just” ... 337 years and 10 months ?.

NordFX Analytical Group

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#eurusd #gbpusd #usdjpy #btcusd #ethusd #ltcusd #xrpusd #forex #forex_example #signals #cryptocurrencies #bitcoin #stock_market

Forex | Forex Trading - NordFX