collins124

New member

After conducting some research, I have come to the conclusion that we are either close to or already in a bull market. According to Google, a bull market arises when there is a rise of 20% or more in a broad market index over at least two months.

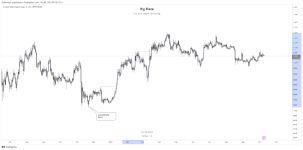

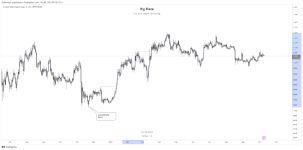

If we look at the market capitalization of the entire cryptocurrency market, we can see that it reached its lowest point in November 2022. Since then, we have observed multiple breaks of structure on a daily timeframe, and there has been a rise of over 20% since the market's bottom. For clarity, I will attach the daily chart.

Based on the above definition and taking into account the upcoming Bitcoin halving in less than six months, it is safe to say that we are already in a bull market.

I am interested to know your opinion on this matter, and also, which cryptocurrencies are you currently accumulating?

If we look at the market capitalization of the entire cryptocurrency market, we can see that it reached its lowest point in November 2022. Since then, we have observed multiple breaks of structure on a daily timeframe, and there has been a rise of over 20% since the market's bottom. For clarity, I will attach the daily chart.

Based on the above definition and taking into account the upcoming Bitcoin halving in less than six months, it is safe to say that we are already in a bull market.

I am interested to know your opinion on this matter, and also, which cryptocurrencies are you currently accumulating?