Wole.K

Active member

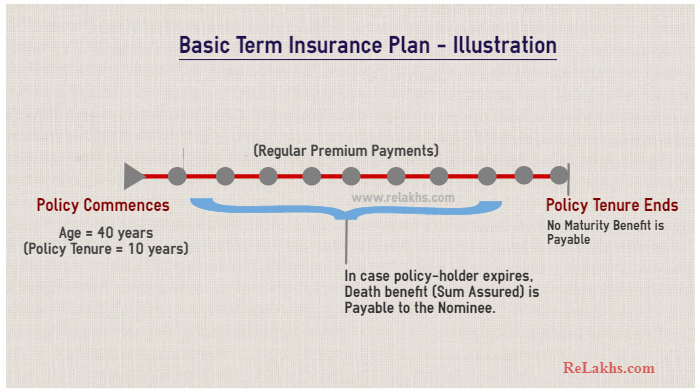

Term life insurance is a type of insurance where the insurer promises to pay a certain amount to the beneficiary based on a contract that is settled upon the insured term. It is a very common coverage to purchase because of its stability and simplicity. For example, if you were to die in two years from today, your beneficiaries would receive the money from the insurance company at the time of your death. The only drawback is that, this type of insurance does not accumulate any cash value during the insured term. Therefore, it can be considered a tax-deductible insurance plan.

The important part of purchasing a term insurance policy is to calculate premium cost and other involved costs such as the death benefit amount and terminal loss amount. This will allow you to determine whether or not to buy additional insurance coverage for yourself or your family. Premium costs and other expenses involved in purchasing life insurance are based on your current health, age and height/weight ratios. These numbers are used to determine how much you will need to pay for insurance.

After knowing the basics of term insurance plan benefits, it is time to move on to the next step and that is choosing from among the various policies and terms that come with it. There are two basic types of plans offered by most companies: The single premium payment plans and the dual premium payment plans. Single premium payment plans offer the least protection possible for your family's future needs, while dual premium payment plans provide more protection for your family's future needs; especially if more than one person in your family is smokers. To help you make the right decision between these two types of plans, here is a quick breakdown of each:

If you want to protect your spouse and children from your devastating financial disaster, you should buy a term insurance plan that offers guaranteed whole life coverage. The premiums for this type of plan are not high, but this type of policy will give you all the protection you need to financially secure your family even when you pass away. You can get a term insurance plan that offers you financial protection for only a specified amount of time after you purchase the policy. If you are a smoker and would like to get a cheaper policy that does not require you to quit smoking in order to buy the policy, you can buy a term insurance plan that does not require you to quit your smoking habit in order to get the lowest premium rate. Quitting your smoking habit does not mean that you will never smoke again or that you will never have to worry about your family ever needing financial protection. If you are looking for the best possible protection for your family, the best way to do so is by getting a term insurance plan that offers you peace of mind for as long as you live.

Single premium, or discount term insurance plans, do not have any age restrictions or income limits, which makes them great for young people who are paying their way through college or for anyone else who is young and still has full-time employment. In most cases, single premium plans provide low coverage for the entire life of the policy owner. For families with more than one wage earner, it is recommended that you consider getting a plan that offers you coverage for your entire family. These plans can provide for a very low cost, long-term protection for your family, while allowing you to enjoy the financial security of low premiums for the entire life of the plan. If you are ready to get the peace of mind that you need to secure the future of your family, take a look at the different term insurance plans that are available to you today.